My Predictions for the CBDC Rollout

Campaigns around equity, Cuban money-handling inspiration, and a possible cyberattack? Oh yeah, I've covered all the bases.

If you’ve never heard of CBDCs before or need a refresher, I’d recommend listening to this episode of The Corbett Report first.

Thanks to the pandemic, central bank digital currencies (CBDCs) have been fast-tracked. (Isn’t it funny how many doors the “pandemic” opened for the government to come in and control our lives?)

In 2020, Benoit Coeure of the Innovation Hub at the Bank for International Settlements noted that:

“There is little evidence that cash transmits the virus but COVID-19 has caused an unprecedented experiment in digitalisation across our lives.”

Oh really? How awesome for us.

Today, Bank of America cryptocurrency analysts are very excited by the prospect of CBDCs. They, of course, paint is as a way to level the playing field between the unbanked and the banked.

But is that really all there is to CBDCs? They’re going to make banking cheaper, faster, and more convenient for everyone involved?

Of course not.

As Amir Najib explains in Irish Tech News, we already have a system of digital currency. It’s how most of us get paid by employers or clients. It’s also how many of us currently manage our money with banks and credit card companies.

However — and this is a big HOWEVER — CBDCs are different:

“Digital Currencies, as conceptualised under CBDC, would be programmable... For instance, wouldn’t it be great if you could program money so that it could only be spent on things that the Banks or the Government approves of? What could possibly go wrong? The point of CBDCs is control. Because when you can program money, Banks/Government can program it to leave your wallet, just because the Government feels that they know best what to do with your money than you. See how well Uncle Sam invests your hard earned tax dollars? Programmable money, aka CBDCs, gives the Government the ability to determine what, how, where and when you can use “your” money.”

When they start being rolled out where you live, what will you do?

My Prediction for the CBDC Rollout

Let’s be honest: The vast majority of people are going to be stoked about CBDCs. They’re going to swallow down every lie the government sells them about using a digital currency vs. fiat money.

But what about those of us who resist?

I suspect the rollout is going to be similar with what they tried with the COVID “vaccine”. They’ll tell us how wonderful it is and how great it would be if we all got on board. But it’s our choice, of course. They’ll allow us to pay digitally or with cash for the time being.

They’ll do a lot of campaigning around the equity of it (because those buzzwords sell!) as well as how much easier it’ll make everyone’s lives. They might even try to convince us that it’ll be a boon for small business owners, when in reality CBDCs are going to mean major profits for companies like Amazon that haven’t been able to reach the unbanked thus far.

After they begin the rollout and see that a portion of the population won’t submit, that’s when they’ll bring the pain.

The Cuban Recipe for Pain

I’m currently working on a short story called Why Do You Have to Be So Difficult?. It’s based on a conversation I had with a friend recently. It’s also inspired by my time in Cuba.

So, back in 2003, I was a student at the University of Delaware. I was studying foreign languages and linguistics in preparation for my career in the CIA. That career didn’t pan out, thank goodness, but it did afford me the opportunity to live in Cuba when so few other Americans could.

One of my Spanish professors was launching a pilot study abroad program to Cuba in 2004 and she invited me to join them. Because I was majoring in three languages at the time, I was required to live and study in at least two countries where those languages were spoken. So I jumped at the chance to go to Cuba.

That’s a 21-year-old me (on the left) in Havana:

Side note: tuKola is far superior to Coke.

So anyway, my experience in Cuba is a notable one, but that’s not what this post is about. What I want to focus on is the payment system there.

At the time, Cubans received monthly rations of everything they needed (i.e. that the government decided they needed) along with a monetary stipend. If I remember correctly, they received 50 pesos. It didn’t matter what they did for work. Everyone from bus drivers to doctors received the same stipend for working.

As an American, I had the ability to pay with my American dollars or with Cuban pesos. I remember our chaperones had advised us early on to exchange our money and to pay in pesos. Some of my classmates didn’t bother. In their minds, they came to Cuba with the intention of spending a certain amount of their money, so why go to the trouble?

But the second I had to open my wallet for anything, I realized why it was far better to pay with pesos. Everywhere we went, there was a different pay structure based on what currency we paid in. And it had nothing to do with the exchange rate.

For instance, there was this little ice cream shop called Coppelia that I’d go to in the afternoons. Me and my friend would order a five-scoop sundae. In American dollars, that would run us $1.50. In pesos, however, it was 30 centavos.

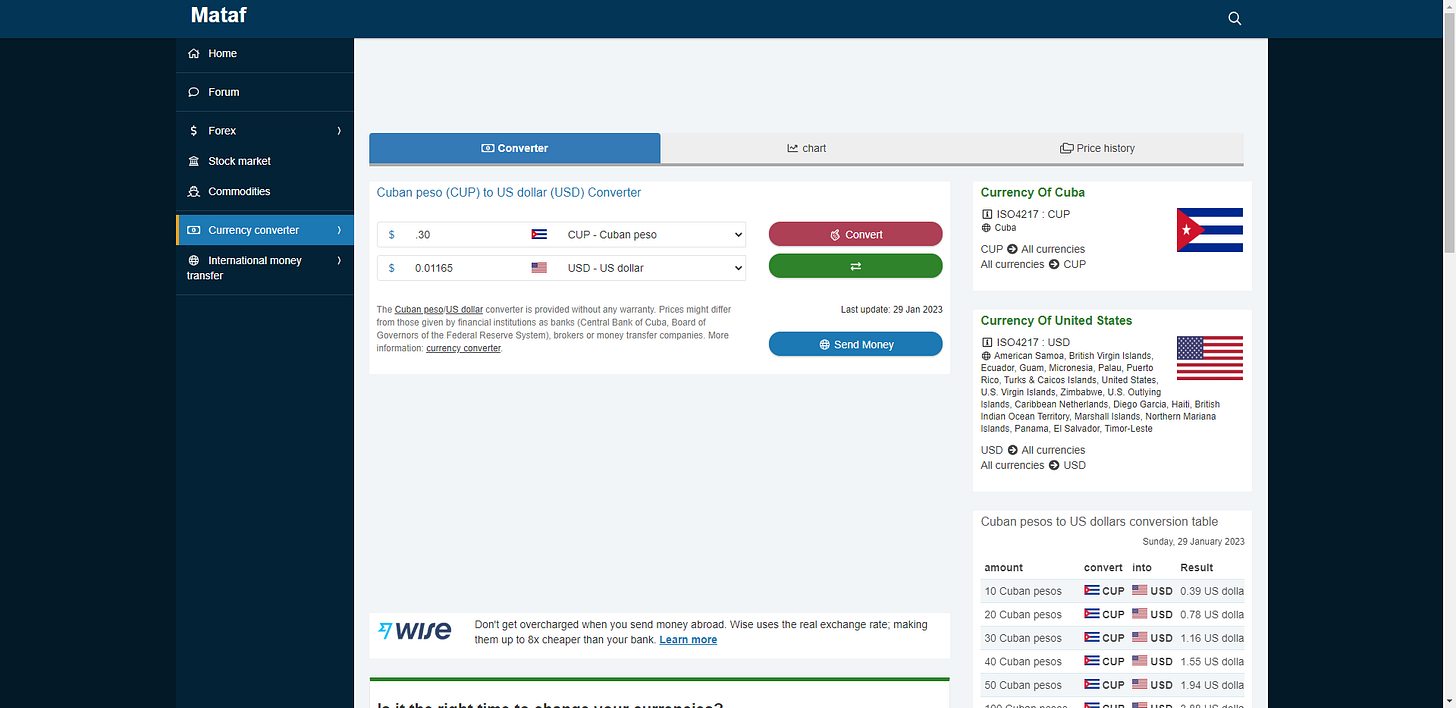

Paying in our home currency would put us at a huge loss. We might not have felt it since $1.50 for an ice cream sundae is unthinkable here, but still. Go to Mataf and you’ll see how the Cuban peso converts today:

A 30-centavo sundae in Cuban pesos should’ve only cost us a penny or two in American dollars.

So back to my story and the CBDCs, I think we’re going to have a similar split payment structure put in place here. The government will tell us it’s fine to pay with whichever currency we prefer. However, those who make the move to CBDCs will be rewarded and those of us who don’t will feel the squeeze.

And here’s how I imagine it’s going to look. Freebel Feast is the restaurant at the center of my short story:

Get a closer look at the Freebel Feast menu here.

Customers who pay in Digee ••• (i.e. “digital dollars” or CBDC) can buy a whole lot more than customers who stick with cold hard cash.

I’m not quite sure yet how I see the exchange rate working out. It’s likely that the Digee will be more or less equal to the dollar. However, businesses don’t have to charge customers as much when they pay in Digee since they, in turn, don’t have to pay as much for their own goods and services when paying in Digee.

Over time, this system will eventually discourage cash-paying customers from dining out or buying from certain stores because they can’t afford it. I also suspect that many businesses will eventually refuse to accept cash because it takes longer to get it on the books (which means less money on hand to spend) and is more difficult to manage.

There’ll definitely be tons of incentives for everyone to make the move to digital. It’s going to be hard to resist, that’s for sure.

Final Thoughts

I don’t know how long it’ll be before we see an official CBDC here in the States. But I suspect we’re going to get a taste of it within the next couple of years.

Someone recently suggested that the airport comms blackout here wasn’t really a blackout at all. That it was a test drive to see if they could launch a targeted cyberattack against a specific industry.

This same person (and I wish I could remember who it was… maybe Bobby Sausalito?) also suggested that the real cyberattack they launch will be targeted at the banks. This, in turn, will be the impetus needed to say, “Hey, your money will be safer in digital form”. And that fear will send people running straight into the arms of their government saviors once again.

I don’t know how it’s going to happen or when exactly. But it feels like it’s coming our way very soon, doesn’t it?

A belated reply to this, but eight days after you published this, the Bank of England produced a lengthy 'consultation' , due to close in eight days' time, on the 'key features of a potential model' CBDC, not on whether a CBDC is needed or wanted. It's worth reading if you have the time and inclination, but I'm sure that nothing in it will surprise you. It's ironic that the supposed 'case' for a CBDC is partly based on the numerous forms of electronic payment that are currently available, when they should actually deem CBDC to be superfluous.

https://www.gov.uk/government/consultations/the-digital-pound-a-new-form-of-money-for-households-and-businesses

My guess as to how CBDC will be implemented is via mortgages and business loans. With base rates now gradually being raised to pre-crash levels (the BoE base rate is currently 4.75% and expected to rise to 5.5%), anyone holding a large amount of debt is in a vulnerable position. In the UK most first-time-buyers get lured into the housing market with a low-interest fixed rate mortgage lasting two or three years, whereupon they will then seek the best deal available, which could just last another two or three years; and so on. It could be that a CBDC loan is the only one available. It would prevent them from withdrawing equity if needed, though it is unlikely that many would want to risk doing so if rising interest rates mean that property prices take a downturn. A CBDC mortgage would also groom those mortgagees to accept CBDC as normal for use in other circumstances.

One other possible area that CBDC could be introduced is if you are lucky enough to get a tax rebate, in the UK from HMRC, in the US I guess that it is from the IRS. That rebate could be time-limited and expire after, let's say, six months if it hasn't been spent. Another obvious area is in welfare payments, which in the UK are rolled up into a package called Universal Credit. It is not yet a Universal Basic Income, but could well be leading into one.